$3.5 billion liability estimated maximum loss in finance, insurance, real estate & manufacturing sectors across MENA

Crisis in the region exposes companies, airports and ports to significant economic exposure.

Show filters

Recent articles

Crisis in the region exposes companies, airports and ports to significant economic exposure.

Fears of global warming are real but that doesn’t mean that very large local geographies will not continue to experience extremely cold temperatures, as the current weather in the U.S. shows.

US military involvement in Venezuela will have consequences for those in the specialty classes.

The potential economic aggregate loss from the ONE Henry Hudson ship fire may amount to $450 million if considered a total loss.

Vulnerability at Thames Water is an example of connected risk in effect.

Cloudflare highlights the need for solution to connected risk.

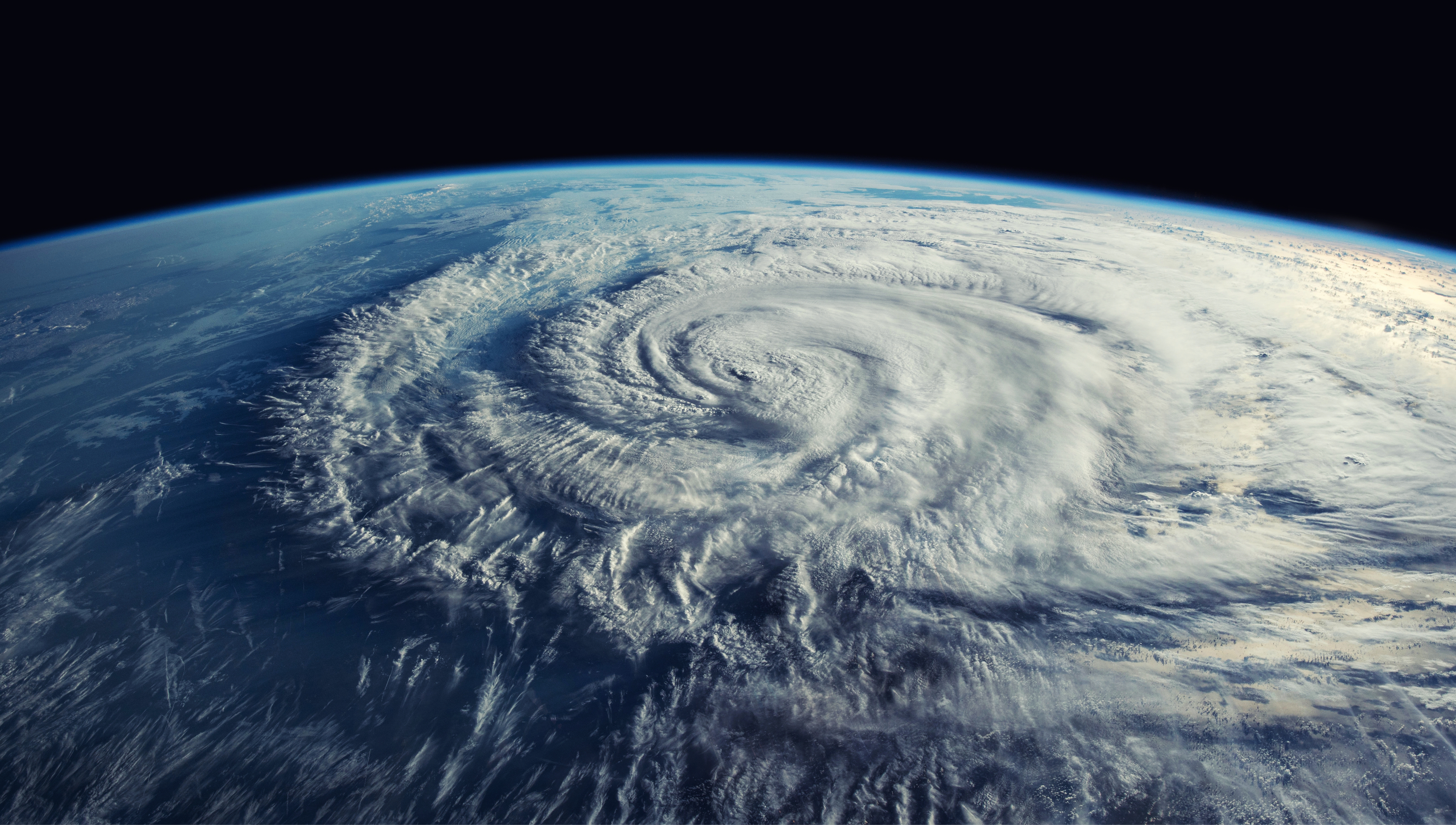

The impacts and key takeaways from Hurricane Melissa.

Amazon Web Service (AWS) outage is connected risk in motion says Russell.

The Atlantic has been quiet and for good reason, but not completely quiet, is this a sign of things to come?

Protests at Italian ports disrupt trade.

“Surprise” Super Typhoon Ragasa Disrupts Air and Sea Freight

Cyberattack on check-in software causes chaos at major European airports.

Trade is moving from West to East, Kirkman-Page said in IPP Presentation.

Not since the days of the Cold War has geopolitics been so front of mind for businesses, insurers and government.

India navigates fallout from 50% tariffs imposed by US.

Low growth recorded for June attributed to uncertainty around US-enforced tariffs.

US Administration imposes tariffs on Brazil and Copper ahead of 1st August deadline.

8.8 magnitude earthquake is the largest earthquake since 2011 Fukushima earthquake.

Ryanair could register aircraft in the UK to avoid EU tariffs levied on US deliveries.

Docking of world's largest car-carrying ship brings into spotlight trade tensions between Brazil and China.

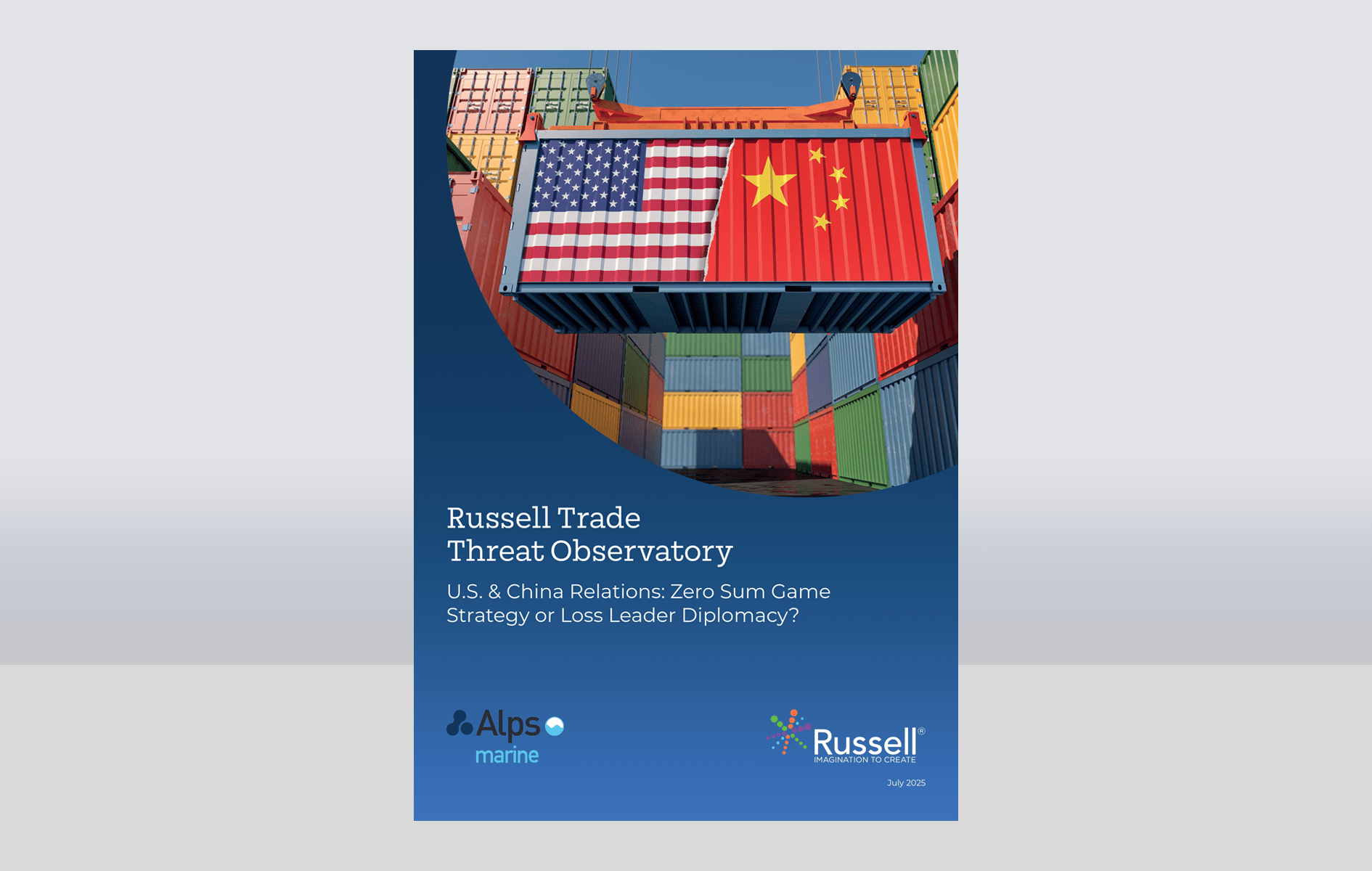

Latest Trade Threat Intelligence looks at China's economic diplomacy.

Lower water levels on Rhine from heatwave are disrupting shipping and raising freight costs.

We analysed the importance of the Strait of Hormuz to global trade

Flights are being cancelled or rerouted from the region following onset of Israel-Iran conflict

Major US airports all experience severe delays and cancellations in a single day because of weather

The collision occured in the Gulf of Oman, near the Strait of Hormuz.

Large parts of US are hit by severe weather resulting in events and flights being cancelled

Maritime cyber threats need to be taken seriously.

Geopolitical instability is major concern for risk managers according to our new survey.

US flights delayed or cancelled because of severe weather, with JFK and Jackson-Hartsfield the most impacted.

World’s advanced economies at risk of GDP loss, if they proceed too quickly with reshoring.

Various factors are conspiring together to threaten airline growth for the year.

Large majority of businesses are adopting AI, as fears around cyber threats grow.

Greenland expands airport at a time of political uncertainty.

South Korean shipyards benefitting in Greece from a shift in geopolitical trends

Global carriers avoiding Pakistan airspace as tensions rise between Pakistan and India

Closure of airspace will force Indian aircraft to alter routes to Middle East and beyond.

The cause of blast at Shahid Rajaee is not known but experts believe it may be chemical explosion.

China’s return of planes comes as trade war with US deepens.

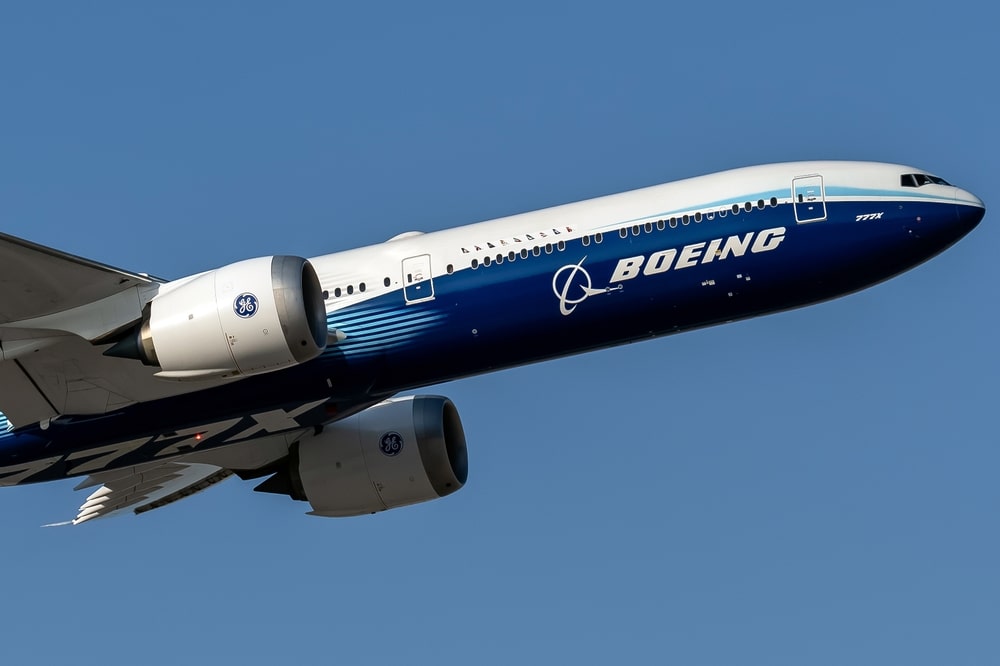

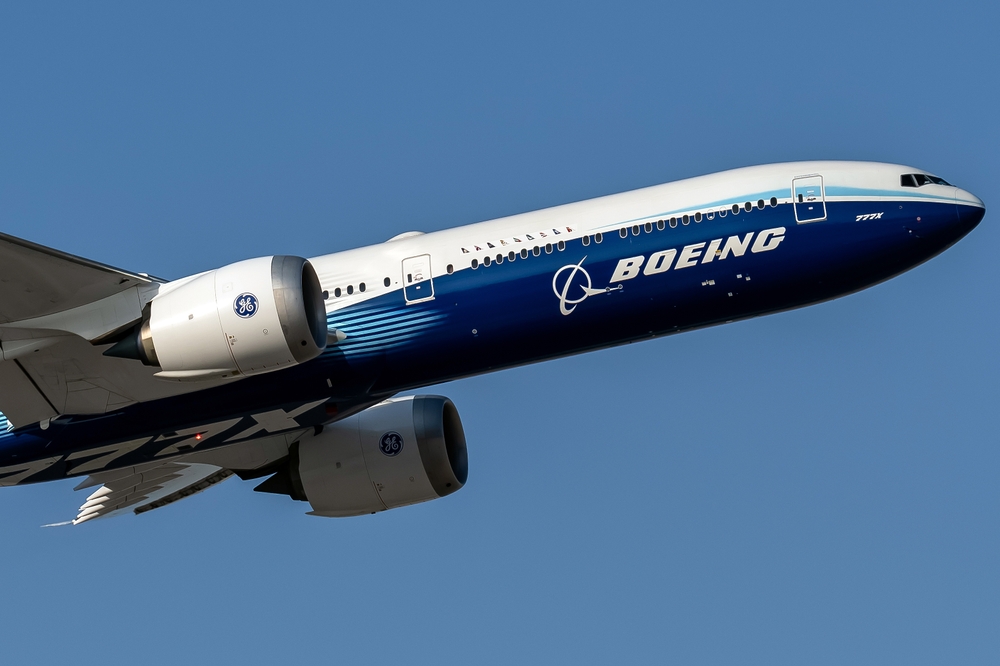

China retaliating against US tariffs by stopping all deliveries of Boeing

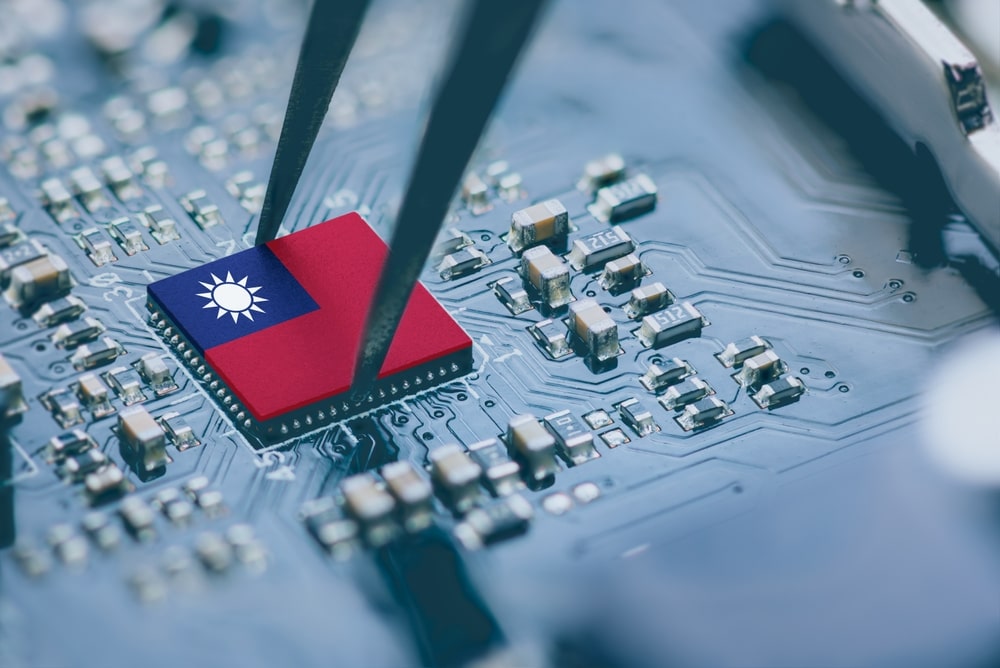

US technology and car firms at risk from proposed semiconductor tariffs

Global Airlines, a new start-up carrier, pledges to “revolutionise” transatlantic flying.

Russell attended the Zywave Cyber Risk Insights Conference

UK Car industry at risk from the new US tariffs on all car and car parts exports.

Myanmar Earthquake has sent aftershocks throughout Southeast Asia, impacting all sectors including aviation and tourism.

In this report, we analyse the triangular risk of the soybeans import/export threats which connect the US, Brazil and China.

Authorities and airlines all want answers following last Friday’s outage

Closure of Heathrow means that flights are diverted to other airports raising possibility of congestion at terminals

100 millions Americans impacted by extreme weather across the country.

Collision between tanker and container ship sparks fears of contamination in the surrounding area.

US Tariffs on key trading partners may impact aerospace supply chains

Insurers reckon with the losses from the Californian wildfires.

Istanbul Airport named Europe’s busiest air cargo center according to new ACI report

US metal importers building up stockpiles of aluminium ahead of new tariffs

Overall passenger traffic at European airports reaches pre-pandemic levels

Leading suppliers and manufacturers are turning to India to ease their supply chain woes

European aviators pushback ambitions as costs for decarbonisation rise.

Falling space debris poses an increased threat to aircraft according to a new report.

Canada's economy is exposed than other countries to the US's tariffs on all iron and steel imports.

Search carries on for cause of crash that resulted in deadliest US air disaster since 2001.

Earthquake activity in the Aegean Sea alerts communities and businesses

Major Airlines including Delta, United and Air India to resume flights to Tel Aviv in Q1.

Preliminary Q4 results show $3 billion in losses for Boeing.

UK and Irish Flights cancelled after Storm Eowyn makes landfall.

Global Aviation revenues expected to hit $1 trillion for the first time

Commodity traders investing heavily in metals such as copper and aluminum

California Fires Update: A Cross Class Event In the Making

UK cleanup costs to reach £9.9bn a year if emissions are uncontrolled

US Wildfires Rip Through California as La Niña, Low Humidity and Lack of Rain Take Effect

Smaller vessels orders rise as shipowners seek to minimise disruption to trade.

Severe weather disruption in UK and US results in flights delays or cancellations

Security experts and chiefs now view supply chain terrorism as a major threat.

Jeju Airlines crash was the third aviation incident in twenty-four hours.

Cyclone Chido Crashing into French Island Territory of Mayotte Shows Power of Globalisation

California Tsunami Triggers Rush to the High Ground, as 5.3 Million People Affected

Flight prices forecast to hit record highs next year, driven in part by a shortage of planes and parts

A closer look at the role that aviation plays in climate change.

Leading airlines threaten to cease all flights to Israel unless changes are made to current Israeli compensation laws

US debt levels are at an all-time high.

Ryanair becomes the latest airline to announce profit falls due to Boeing order delays.

We are seeing an unusually prolonged hurricane season.

Extreme weather events are becoming more regular, posing a threat for the Aviation sector.

Largest stock sale in history raises hope that aerospace giant can avoid credit downgrade.

In a world of changing risk, has the moment for parametric insurance arrived?

Travelers turning away from Middle Eastern nations towards Gulf nations as turmoil in region rises.

Insider Progress event discussed utilising neurodiverse people are often highly creative and often bring different ideas to the table.

Boeing racks up $8 billion loss for year as series of crises leave a financial hit on company

Iran’s stock market falls and foreign flights are cancelled in anticipation of Israeli attack on Iran

FCA fines VW Finance Services fined £5.4 million for mistreating UK customers in financial difficulty.

Boeing slashes 10% of workforce as the strike takes a toll on finances

BA axes hundreds of flights from the winter schedule following aircraft shortage.

Leading Florida sports teams and stadiums suffered disruption as a result of Hurricane Milton.

With Hurricane Milton reaching category 5 so quickly, do we need a 'category 6' for storms?

Hurricane Helene floods mines in Spruce Pine, which are responsible for 90% of the world’s ultra-pure quartz.

A solar storm classed as G4 may create widespread disruption to radio and electrical systems.

?Typhoon Krathon created both connected risk and BI risks for businesses.

More flights to Beirut and Tel Aviv cancelled following strikes on Lebanon.

The aftermath of Storm Helene reveals the multi-class risks from storms.

$63 billion knock to the US economy from a looming US East Coast port strike.

British department store Harvey Nichols is reportedly the victim of a cyberattack.

45,000 workers across 36 ports on US East Coast threaten strike on 1st October if labour talks fail.

30,000 workers who produce Boeing 737 Max and 777 strike over pay and pensions

Russell latest's white paper on transit route accumulation is available to download here.

Analysts warn that the partial closure of Ben Gurion airport on 2nd September may disrupt flight schedules.

Connected Risk came of age in 2024 with Russell Group moving the concept from its (re)insurance market silo into a tangible business user case.

Asian Aviation officials are calling for global action to reduce injuries from turbulence.

A new wave of sanctions by the US is focused on Russia's military-based supply chains, according to a report.

Geopolitical instability continued to affect global trade in the second half of 2024, says a new report.

Industry grapples with familiar issues as it enters a key season

$131 billion in trade at risk of disruption from current port congestion at three ports

Taiwan braced itself as the super typhoon Gaemi hit today

Major IT outage has resulted in delays across airports.

Cargo Ships encountering more risks in their efforts to avoid the Red Sea

Highest Number of US Passengers screened on single day.

US airports will see a large number of flights during the 4th July weekend.

Severity of losses in certain lines of US Casualty is outstripping economic inflation.

Record level temperatures in US delays thousands of flights

Damage to undersea cables may impact global data flows.

Port strikes at five key five German ports may cost $6 billion (£4.71 billion) in lost trade.

The latest episode of Risk Radar looks into how the El Nino effect is impacting the Atlantic Hurricane season.

Financial losses of major space storms could surpass losses of events like Katrina.

Factors contributing to a likely rise in ticket prices, an aviation body warns.

European retailers are ordering items earlier in the year to avoid disruption during the festive period.

Numerous factors are contributing to uncertainty for Aviation sector

Western Med transshipments hubs experiencing large demand which may exceed capacity.

The Red Sea attacks and Panama Canal drought amount to a “double strike” on shipping and supply chains.

The continued closure of Baltimore Port may mean a loss of trade of $10 billion, according to Russell’s Analysis.

US Airlines are deploying A.I. across their business, from customer support to fuel-efficient flights.

The First Connected Risk Outcome-Based Policy Unveiled by a member of the Russell Working Group.

The aviation industry is facing a supply chain bottleneck, with a shortage of aircraft seats.

Longer Shipping Transits Sparks Fears of Inflation.

Our analysis shows that $8 billion of aircraft was on the ground at Dubai airport during last week's rainstorm.

Escalating conflict between Israel and Iran is impacting many classes of business including Aviation.

European aviation industry has been focused on avoiding any delays this summer.

Pile-up of vehicles at European Ports blamed on logistics and sales issues.

Taiwan Earthquake Raises Fears of Disruption across Technology Supply Chain

The price of chocolate is expected to rise because of a shortage of cocoa beans

The closure of the Port of Baltimore for six-weeks due to the collapse of the Baltimore Key Bridge could result in $8 billion of lost trade, Russell's analysis can reveal.

Experts are concerned about the rise in GPS Spoofing.

The Panama Canal Authority increases available spots for daily transits, but overall transits are still below their peak levels.

Air Cargo demand experiences largest surge since 2021 but outlook is far from certain

Delays in Boeing & Airbus aircraft may impact capacity during summer travel season.

New survey reveals extent of disruption for UK exporters and retailers from Red Sea disruption.

The impounding of thousands of luxury cars at US ports due to a breach of anti-forced labour laws has been described as the "weaponisation of trade".

Recent Munich Security Conference highlighted the 'overlapping complexity' within today's international threats.

Parts shortage and delivery delays is impacting the aviation industry

The recent service outage at AT&T was not believed to be a cyber-attack.

With busier airports, experts are concerned about a rise in ground collisions.

A quarter of all British tea imports is at risk from the current Red Sea disruption

Large and complex supply chains are being targeted by cyber-attackers.

The airline insurance market will face rising claims soon, says a new report.

Boeing faces new delays of 737 Max after key supplier finds glitches in production

Vessel owners facing mounting pressure to travel through Red Sea.

$3 trillion of trade is at risk if trade within the Suez Canal and Red Sea is blocked because of continued attacks in Red Sea says Russell.

9,100 flights were cancelled or delayed in USA because of cold weather.

Ocean Cargo rates climb in wake of Red Sea Attacks

171 Boeing 737 MAX 9 planes were grounded after Alaska Airlines jet suffered a mid-air blowout

Container firms avoid Red Sea after Houthi attacks on vessels.

Japan Airlines plane caught fire after a collision with a coastguard plane at Tokyo Airport.

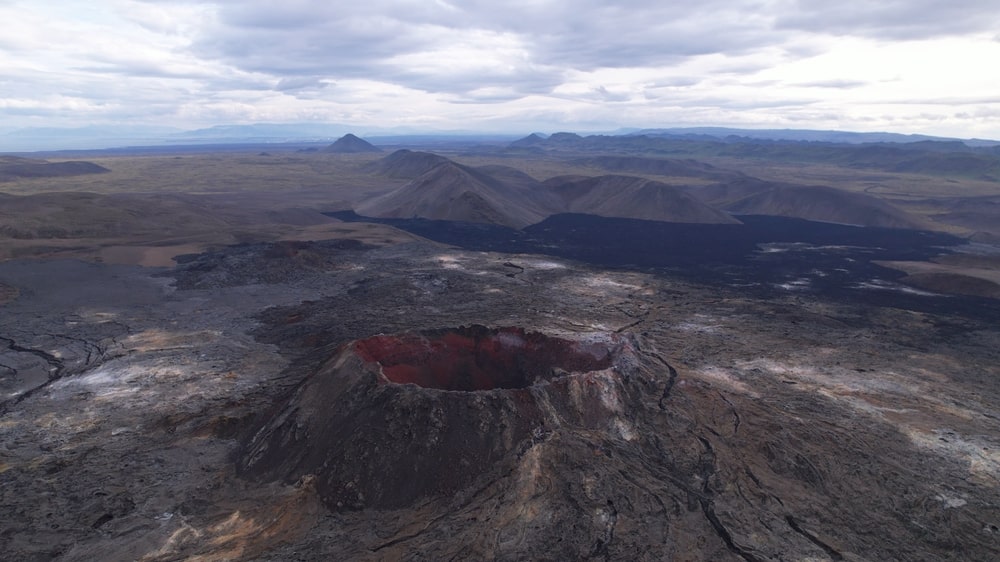

Reykjanes eruption will not result in grounding of air travel like the 2010 eruption did, say experts

2024 set to be a seismic year with 40 elections across the world with far-reaching implications.

£22 million pounds worth of fresh vegetables, fruit, coffee, tea and meat products may be in short supply in the run-up to Christmas due to shipping delays according to Russell.

Insurers are exposed to climate change from investment in fossil fuels and underwriting of NAT CAT risk, a watchdog has warned.

Understanding the potential connected risk from the current cold weather spell.

Airlines see bookings fall in the weeks following the onset of Israel-Hamas war.

Comparisons have been made between a potential new volcanic eruption in Iceland and a previous eruption that occurred in 2010.

War risk exposure for maritime underwriters increases as Israel-Hamas conflict deepens.

A five-day strike called by meat workers and port workers to impact £5 million ($6.13 million) of meat products into Belfast.

US autoworkers suspend six-week strike after reaching deals with “Detroit Three”

Shares in US and European firms with exposure to Israel fell due to fears of escalation in crisis

Airlines suspend flights to Tel Aviv in wake of attacks on Israel.

The recent catastrophic Typhoon Koinu has impacted Taiwan's semiconductor industry.

In part two of our series on the IUMI Conference, we examine how the lessons from other classes can be applied to Marine Hull

This is part one of a two-part blog exploring the key takeaways from the recent IUMI Conference

The Libyan catastrophe highlights why environmental risk needs to be understood as a key connected risk.

Aer Cap agrees a $645 million settlement over 17 Russian planes and engines leased to Aeroflot

?Russell's latest white paper analyses transit route accumulation.

Vietnamese Trade is booming as businesses look to reduce dependency on China.

Typhoon causes serious damage in East Asia.

Russell analysis reveals Mercedes has a significant exposure to Fremantle Highway Fire.

Chis Don sat down with James Banasik, Head of Connected Risk, to discuss the extraordinary weather we are currently experiencing.

Germany redefines trade relationship with China in effort to make German firms more resilient.

A PRA review of the insurance sector highlights concerns about claims inflation

Airlines are riding a wave of high passenger demand but economic woes may dampen demand

A coalition of insurers, brokers and risk managers have called for public and private cooperation to find solutions to tackle cyber risks.

We explore why lawsuits involving airlines are higher in Brazil than in any other countries.

Space Insurers need to address the rise in LEO satellites.

Lloyd’s searches for a corporate to pilot its first captive in over 20 years.

Leading Maritime Market Figure calls for a ‘Plan B’ on Russia sanctions to help maritime market

Exporters are cautious but optimistic in uncertain times according to a market survey.

Forum was dominated by one major topic: The Russia-Ukraine conflict

US Companies under pressure to disclose China-linked exposures in supply chains.

A Reuters article on offshore energy assets outlines exposures in the white wind turbine tower industry in the Taiwan Strait.

Nevado del Ruiz Volcano Alert - The Indirect Globally Connected Consequences of Eruptions

Tensions in Strait of Hormuz could jeopardise $227 billion in Crude Oil exports

Worsening situation in Sudan is likely to push up premiums even further.

Russell Group attended the Zywave Cyber Insights Conference held on the 19th April.

Political risk losses surge in 2022, finds WTW survey.

Three aircraft were damaged at Khartoum Airport during the current fighting in Sudan.

The recent shutdown of LA and LB ports highlight some issues at one of US largest ports.

Analysts warn that rising oil prices may deepen the current economic difficulties.

Price hikes from April Renewals may be passed onto customers.

Middle and Top Layers rates rise due to losses from Russia-Ukraine conflict and Boeing claims.

Space Debris and LEO Satellite Boom poses new risks for Space insurers

SVB Bank collapses from a bank run but UK arm rescued by last-minute buy by HSBC

Proposed changes to French pension system indirectly affects the French transport, education and energy sectors.

Leading insurers continue withdrawal from fossil fuels insurance as climate risks loom large

Organisations need to be agile and perform scenarios analysis to tackle supply chain risks, argues new report.

Cyclone Gabrielle strikes New Zealand, creating new connected risk perils.

Container fire is estimated to generate $679 million in trade disruption says Russell

Earthquake in Turkey poses a series of Connected Risk perils for (re)insurers and their corporates

The Philippines is facing an onions shortage that threatens the country’s geo-political and economic stability.

Survey of members shows concerns about landscape of insurance market going into new year.

Supply Chain risks to continue despite pressure easing on trade and at ports says new analysis

A corrupted file affected both the main and backup computer systems used by the Federal Aviation Administration this week.

Reinsurance costs rose by as much as 200% in Jan renewals according to new report.

Quarter of all Russian crude shipments since Dec have been insured by Western companies according to FT.

The cold weather drives up the amount of energy we need, as well as how much we pay for it.

A run through some of the events of 2022 makes it clear that this year has been nothing short of a “permacrisis”.

Russell achieves re-certification of ISO9001, 27001 and 22301.

Climate Change needs to be regarded as a systemic risk according to a new report.

In the first of our blogs on the LMC Conference, we explore why data was a consistent theme throughout the conference.

In the second our blogs on LMC Conference, we look at the modelling and aggregation of risks.

Claims from Hurricane Ian are expected to hit the London Market and beyond.

The Global Outlook is uncertain according to expert analysis.

With COP27 taking place in Egypt, we outline some of the challenges facing delegates.

With COP27 in full swing, we look at how insurers are leading the way on climate action.

New COVID outbreak in China disrupts production at key iPhone Factory.

Houston overtakes LA and Long Beach as most congested US port

Global credit risks are rising, as fears of recession loom according to a new report.

Current wave of port strikes may continue until year’s end according to new report.

Russell Group has appointed James Banasik as Head of Connected Risk.

AerCap faces lengthy battle to secure $3.5 billion from insurers after seizure of aircraft by Russia.

Russell has highlighted several potential vulnerabilities impacting the specialty insurance classes from Hurricane Ian.

Toys, video consoles and clothing commodities worth £100 million could be disrupted by the strike.

Hurricane Fiona knocked out power, sparked landslides and caused gigantic floods in Puerto Rico.

French Government Urges Insurers to Assist in Cost-of-Living-Crisis.

Our new white paper explores how Marine, credit and political risks (re)insurers play an important role in the flow of global trade.

We are pleased to announce the publication of our new Russell Book: "Imagining Outcomes For Uncertain Times".

Loss data will power additional insights into Connected Risks for (Re)Insurers and Corporates

The ongoing energy war between Russia and the West is heating up, as winter approaches.

The agreement gives VW and Mercedes-Benz access to vital raw materials for use in electric vehicle batteries.

Many experts are concerned that the US and China may be "sleepwalking" towards a crisis over Taiwan amid fears of a Chinese invasion.

The current strike at the port of Felixstowe could result in over $800 million in trade being disrupted according to the ALPS Marine analysis by Russell Group.

All assessments and projections indicate that Europe will experience a harsh winter this year due to the Russia-Ukraine war.

Delays in border system create huge delays for passengers and lorry drivers

Half a trillion dollars wiped from valuation of leading FinTechs as inflation concerns spook investors.

Port Congestion fears as tens of billions of dollars in trade is trapped at land and at sea

Imagination and collaboration needed by corporate risk managers to deliver outcome-based solutions

Premier League teams are suing insurers, alleging that BI interruption policies were triggered multiple times not once.

Russell attended a IATA presentation at Lloyd's of London on the 28th June 2022.

Ford is recalling nearly 3 million vehicles to fix a transmission problem that can increase the risk of rollaway crashes.

New Sensors are being created to help Satellites avoid collision with million of pieces of space debris.

Cyber insurers can help improve cyber resilience for organisations across the global economy argues a new WEF report

Insurers are already influencing the global energy transition in many ways.

UK and EU joint insurance ban heats up sanctions on Russia.

Oil and Gas production requires new connected safety solutions according to a new report.

ESA satellite narrowly escaped a “high-risk collision” from the 1,500 trackable orbital debris from a 2021 Russian missile test.

Art Collectors in California, Florida and Connecticut are experiencing difficulties in obtaining and renewing their insurance because of climate change.

A race to develop quantum computing in cybersecurity is underway as governments and the private sector invest in full stack development technology..

The consequences of the Ukraine conflict are felt across the global economy

By focusing on Europe, many leading Western nations could be distracted from focusing on other regions such as Indo-Pacific.

Shanghai's lockdown rocks the global supply chain, creating delays for consumers and companies alike.

Shortage of Pilots Force Airlines to cut flights as the Holiday season approaches

US President Joe Biden announced last week that he intended to ban Russian-affiliated ships from US, following similar moves made by Canada and European nations.

Russia re-registers 150 foreign-leased aircraft as lessors write off missing aircraft as a loss.

Russia’s withdrawal from the international space station raises questions about the future of international space cooperation.

Vessels are coming under scrutiny from a variety of tracking initiatives, bots and data providers.

The war between Ukraine and Russia has already started to impact both UK consumers and the wider economy.

Disruption at Dover port creates chaos for companies and holidaymakers

LMA adds Russia waters to "listed areas" of war, piracy and terrorism hazards

Shanghai's lockdown threatens the country’s economy and could “tear apart” stretched global supply chains.

China is facing its worst COVID crisis since early 2020 with the consequences impacting the global economy.

All of us will be confronting the consequences of climate change in our day-to-day lives including corporates and (re)insurers.

543 Boeing & Airbus aircraft that will be seized by the Russian Government under new legislation carries a market value of $13 billion.

589 Western-Built aircraft with an aircraft market value of $13 billion are currently on the ground in Russian airports

Russia-Ukraine War is undermining the global economy, disrupting supply chains, and jeopardising consumers’ incomes.

£17 billion of annual Russia exports to the UK will be disrupted by the closure of all UK ports to Russian ships.

Russia’s invasion of Ukraine will threaten $8 billion (£5.9 billion) dollars’ worth of wheat and corn exports from Ukraine according to Russell's analysis.

Over 30 European countries have closed off airspace to Russia following Ukraine Invasion.

Felicity Ace fire expected to generate $155 million economic loss for Volkswagen, Porsche, Audi, and Lamborghini according to Russell analysis

Airlines avoid Ukraine airspace and insurers pull out of country as crisis deepens.

Port operators raise alarm over lack of clarity on charges and checks at new government border posts

New survey identifies Climate Risk & ESG as the two emerging risks for the London Market.

In the era of home working, Lloyd's mulls over the future of the Richard Rogers Building.

Merck & Co. wins court victory over $1.4 billion claim in losses from NotPetya attack.

US Airlines warn that impending 5G signals could create major disruption to flights

The global port congestion crisis created by the COVID-19 pandemic is showing no signs of letting up according to Maersk.

Surges in Omicron variant and adverse weather combine to ground US flights.

The pandemic has fueled underwriter concerns about liquidity, uncertainty and systemic risks.

Omicron variants spook stock markets with fears of more restrictions

In the last few years, the largest risk events that have impacted corporates have been a result of new risks

What new risks have been created in the economy from COVID-19 pandemic?

Air Freight rates soar as companies try to secure products before Christmas

COVID-19 has sped up the transition towards a "frictionless" consumer economy

30 Tornadoes reported across six states add up to a year of high insured cat losses

New survey shows that investors regard ESG as key tool in making investment decisions

News-Roundup: Starlink increases share of all satellites and insurers called to give resilience "insights".

Russell attended the Insider conference which debated the future of EC3 - along with the opportunities and challenges.

‘Small’ UK ports like Liverpool are benefitting from pickup in trade due to global supply chain disruption

Global HS Codes and associated tariff codes to be updated next year as experts warn of a mini trade Y2K.

Russell Group recently attended the Irish Funds Annual Global Funds Conference.

Russia blows up its own satellites in a test, creating 1,500 pieces of trackable orbital debris

Suki Basi writes in Insurance Day on why monitoring trade can help businesses maintain a competitive advantage.

UK Supreme Court ruled in favour of Google in a compensation case involving data privacy that would have cost $3 billion.

Financial Institutions commit to assuming “fair share” of effort to combat climate change.

Semiconductors are an important component of many commonly used electronic devices including smartphones, tablets, and PCs.

A large amount of water is needed to produce semiconductors.

In our final blog on our series, we examine the future of the semiconductor industry.

In the first in a series of blogs on semiconductors, we look at the large amount of water it takes to produce a silicon chip.

COP26 starts this week with all the eyes of the world watching to see the outcome.

We highlight five growing trends in cyber security which consumers and organisations need to watch out for.

SK Broadband, a South Korean internet service provider, has sued Netflix for compensation for higher network usage costs.

China's unprecedented Energy crisis is expected to have a serious impact on their economy

Bad Harvests in Canada, France and Italy could mean consumers have limited supply of pasta that will be more expensive

Shatner will become the oldest person to fly in space as the sector experiences a large boom in financial investment.

The supply chain crisis has now turned into a crisis that is hurting energy, labour and transport sectors globally.

Growing issue of port congestion across the world unnerves shipowners, consumers and insurers

The global spike in energy prices threatens to derail the post-COVID recovery of many economies.

UK fintech firms move into lucrative “buy now, pay back later” sector which regulators fear is unstable

The recent gas price hike has created a CO2 shortage, creating serious disruptions for many UK industries.

Supply Chains experts warn of looming shortages for UK consumers

Concerns about space debris has led to many insurers restricting satellite coverage.

Wall Street firms accused of 'greenwashing' and manipulating their ESG targets.

Industry receives billions in investment despite producing more emissions than leading countries.

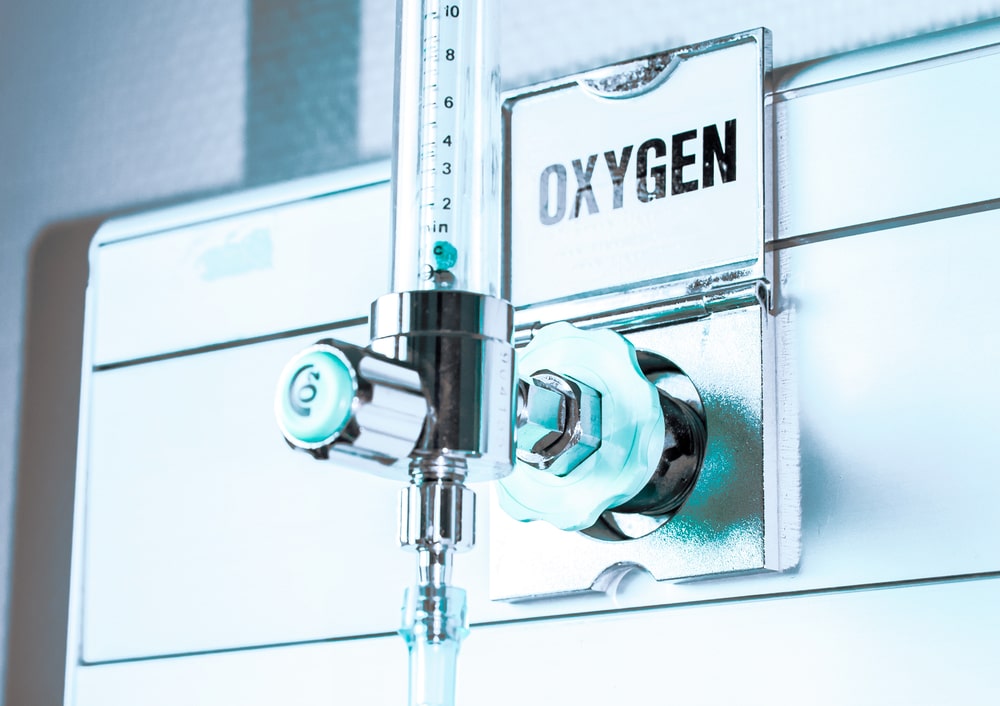

Oxygen supplies have been tightening in parts of the U.S. due to medical use of the gas for Covid-19 patients.

Space launches such as NASA’s Landsat 9 satellite have all been delayed due to a nationwide oxygen shortage.

Russell Group employee, Felipe Hassin writes on his experience of travelling during the COVID pandemic

In the second blog, Felipe discusses travelling from Brazil to USA via Mexico and describes his flying experience.

SpaceX satellites are involved in more than 1,600 close encounters every week according to new University analysis.

Survey shows that 10% of current office space in London will fail new energy regulations set to be introduced in 2023

Ryan Specialty Group, AXA and CNA Hardy all suffer cyberattacks as industry readjusts to dealing with cyber insurance

Lloyd’s vows to bring in low-carbon transition as brand is under threat from climate inaction

Global shortage of semiconductors narrows industry’s profit margins but shift to central electric “brain” may help to resolve issues

Global shipping trade is being disrupted like never before by the COVID-19 pandemic.

Partial Closure of China’s second largest port adds to the continuing strain on global supply chains

Risk leaders are worried about new interconnected risks and believe that modelling and data analytics is a solution to this.

Silent Cyber policies can mean that (re)insurers pay claims that were both unexpected and priced incorrectly.

£750 million will enable the live-event industry to host events in the COVID-era.

European football clubs’ revenue declines by £3.4bn during the pandemic.

Legacy Airlines clash with low-cost airlines over lucrative slots as industry attempts a “return to flight”.

Coffee prices surge to 6-year high as extreme cold threatens Brazil's crops

Key companies in the Opioids lawsuits agree a $26 billion settlement with US states/municipalities.

The devastating floods in western Germany last week could become one of the most expensive natural disasters in the country of the past 20 years.

The UK Government's new energy white paper outlines its intentions to set in law a world-leading climate change target.

Ocado cancelled thousands of orders after a fire at a fulfilment centre in south-east London on Friday, caused by the collision of robots at the facility.

Business Strategies need to be agile to cope with Market Disruptions says Board Members

Insurers and investors are well positioned to put pressure on individual companies that are failing to transition to more climate-friendly business models.

What challenges will the aviation sector face as it attempts a “return to flight” in the COVID era?

A new report says that the pandemic may have changed trade credit underwriting

Sweden's Coop supermarket becomes the latest victim of a ransomware cyberattack.

Ever Given ship finally released after company and Suez Canal Authority agree financial settlement for disruption caused by blockage earlier this year.

Leading US cyber insurers join forces as the US cyber insurance market reckons with the rise of cyberattacks across the US.

Chief executives from the UK’s largest insurers have joined forces with the Prince of Wales to launch a sector-wide taskforce aimed at tackling the climate crisis.

Potential ban on China’s solar material over forced labour claims put climate change goals in check

JBS, the world’s biggest meat producer, has paid U$11 (£7.8m) in cybercrime ransom, making it the latest high-profile organisation to fall victim to a cyber attack..

Russell Group has officially launched a cross-industry ‘Russell Working Group’ of risk managers from leading large corporates across multiple sectors.

Organisations and their risk managers can model their previously unknown risks.

Facing new coronavirus quarantine rules, thousands of UK holidaymakers were scrambling to leave Portugal early this week.

Suki Basi talks about Russell Working Group and the importance of the risk stack.

Carriers now require analytical tools that not only identify the critical risks, but can also monitor them in real time

As lockdown starts to relax across many countries of the world, Suki Basi, MD of Russell Group Ltd, asks what effect the pandemic has had on working life and explores the long-term ramifications.

The Colonial pipeline attack represents a watershed moment in how people think about cybercrime.

The rise of ransomware attacks means that corporates need to take cyber security seriously or they will find themselves dangerously exposed.

Businesses are looking to captives to move strategic risks off their balance sheet.

Brussels Airport has played a key role in transporting the vaccine to more than 40 destinations across the globe.

Better quality risk data will be needed as trade credit insurers prepare themselves for future claims.

Combining scenario and exposure modelling will help corporates and insurers to price risk better.

The aviation industry is facing a fight for its future and in doing so will have to re-think it’s future.

As technology continues to disrupt the insurance industry, the solution is not just more data.

International trade is now dominated by global value chains, which increase the risk of greater trade disruption in the future.

Globalisation has accelerated international trade but has left organisations exposed to new risks in the process.

COVID-19 has triggered a rise remote working but what are the long-term consequences of this?

With many organisations operating from home, how have employees and employers adjusted to this "new normal"?

In the era of COVID-19, many organisations and employees were forced to work from home, creating both new opportunities and risks.

Over the next three blogs we intend to explore the risks and opportunities of remote working.

Never has an US election been more analysed, debated and watched than the most recent one that saw Joe Biden elected President of the United State of America.

In the final part of our series exploring the impact of COVID-19, we look at how the transportation layer will play a key role in the distribution of a vaccine.

In the second part of a series on the impact of COVID-19, we look at how the pandemic has accelerated technological innovation across multiple sectors.

Airlines will resume normal operations more quickly if industry and political leaders work with rather than against, public health professionals writes Suki Basi in Insurance Day.

In the first of a series of blogs on the impact of COVID-19, we look at how the initial COVID-19 outbreak in China disrupted supply chains across the global economy.

Risk assessment and mitigation strategies deployed by most carriers are not designed to cope with the rapidly shifting nature of the risk environment writes Suki Basi in Insurance Day

Professional Indemnity (PI) insurance is once again back in the headlines, with growing concerns about a COVID-19 driven recession and uncertainty surrounding Brexit driving up PI premiums.

The London company market is in a strong position despite Brexit and COVID-19.

While climate risk threatens to increase over the coming decades, it is also leading to innovation in environmental liability insurance writes Suki Bas in Insurance Day.

While the aviation industry reels from the impact of COVID-19, there are some in the sector who are planning for the future.

To remain attractive to third-party capital, the reinsurance market must regain a three-dimensional view of the risks it writes says Suki Basi in an Insurance Day article.

Recent events like Hurricane Laura or COVID-19 have highlighted the significant exposure the interconnectivity of commercial risks represent to insurers writes Suki Basi in Russell Group.

From the supply chain woes in 2018, to the grounding of the 737 MAX in 2019 and now COVID-19, it has not been the best of times for everyone involved in aviation.

COVID-19 has profoundly changed the rules of the game for D&O, just when this product offering is needed more than ever.

Recent multiple losses across the FinPro class is concerning for casualty underwriters

The solution to the issues outlined in this blog is to collect data to measure the connectivity between the economy, banks, insurers and longer investment strategies.

Credit risk has increased across all asset classes, in particular CDS of government bonds, financial and non-financial corporate bonds have increased sharply.

Just like banks, insurers are financial intermediaries as far as their life insurance business lines are concerned.

The finance sector as represented by insurance and banking has both asset and liability risk exposure in any economy, which has been considerably increased by the COVID-19 pandemic.

COVID-19 has been a real liability for business despite lockdown measures are eased.

Part two in a two-part series on COVID-19 and its impact on supply chain and employee liability.

Apple announced that it would be replacing Intel microprocessors used in Mac Computers with their own chips, signaling the end of a 15-year partnership.

COVID-19-related losses in first quarter of 2020 has resulted in the global reinsurance sector being placed under negative outlook by S&P.

IATA and ACI have called for all new air safety measures to be consistent across all nations.

Global Growth in new renewable energy capacity fell for the first time in 20 years according to the International Energy Agency (IEA).

The age of social media poses a significant challenge for organisations who want to protect their reputation.

The Insurance industry must adapt to the fundamental changes taking place in the energy sector to remain relevant writes Suki Basi in Insurance Day.

Need for enterprise-wide strategic analysis of the impact of perils on the commercial property market.

This Week in Marine: Maersk predicts 25% fall in container volume, Shipping Industry in the Red, French container line firm secures historic state-backed $1.14 billion loan

Low demand caused by the COVID-19 pandemic has forced all airlines to resize their fleet and flight operations.

IAG is “burning through cash”, UK carriers predicted to lose $26.1 billion in revenue and UK Government imposes two-week quarantine on international arrivals.

Shipments are being cancelled and containers are piling up at major transportation and logistics hubs due to COVID.

The global aviation industry warned on Tuesday this week of a severe cargo capacity shortage as airlines around the world slash jobs and suffer plunges in profits due to the coronavirus crisis.

Leading aviation experts and companies warned that the industry will take five years or more to recover to the pre-coronavirus level of demand.

Russell Group suggests five steps that would help to promote public confidence in any post-lockdown plan

The fundamental nature of supply chains will change as organisations seek to ensure their business is robust enough to survive future shocks like COVID-19.

With professional leagues all around the world suspending their activities to prevent the spread of the virus, including the Olympic Games, every part of the sporting value chain has been impacted.

Lloyd’s is rumoured to be in discussions to set up a £100 million fund to tackle COVID-19, according to industry analysts.

While the coronavirus pandemic has severely impacted every sector in the global economy, it has hit the aviation sector the hardest

While pandemics may not have ranked highly on corporate risk registers, lessons are still being learnt.

With April Renewals just finished, we analyse the underlying trends from a market view and across the specialty classes.

If Covid-19’s impact on health systems and economies around the globe is already quite clear, there is little we do know about its potential impact on the world’s politics afterwards.

This is the first part of a two-part blog on Coronavirus and Cyber as cyber warriors have been exploiting the pandemic to target organisations and individuals.

Many experts are worried about a potential cyberattack during the current coronavirus pandemic.

A long-term shift that is occurring because of the pandemic, is a fundamental restructuring of the economy that is underpinned by“transportation layer”.

The current COVID-19 pandemic is both disrupting and transforming our lives.

Maersk has launched a $5 billion credit facility with sustainability terms and conditions attached, which is the first of its kind in the shipping industry.

The final article in our series on the rise of the "intangibles" explores how behavioural economics could help businesses to making better decisions that can improve their balance sheet.

The second article in our series on the rise of "intangibles", we explore the less talked about intangible asset: people.

The shift from the tangible to the intangible - from goods to services - is happening all across the economy. How does the world of risk and insurance adjust to this new reality?

China has held back some ships from calling at the port of the city of Wuhan City, in the Hubei province of China as part of a lockdown of cities affected by the coronavirus.

In our final blog, we explore the fallout from the opioids epidemic, which has resulted in large legal claims and shows no signs of letting up.

Roundup has been subject to a series of US court cases on the potential links between the chemical and cancer.

Claims from exposure to diesel fumes, particularly diesel exhaust throughout an individual’s employment, are on the rise and should be a concern for carriers covering Employers’ liability.

Boeing officially lost its title as world’s largest plane manufacturer after reporting its lowest annual orders in more than two decades.

Global supply chains are increasingly complex and interconnected. In turn, the consequences of disruptions to them have become increasingly difficult to asses

Cybersecurity remains on the forefront of daily news highlights worldwide with several of those uncovering several notable breaches, including one of the largest known-to-date.

In managing for the Christmas rush, Amazon has stumbled onto something of an old school concept: cheap warehouse space.

The festive period in the U.S. may be a bit more expensive this Christmas. That’s because the price of natural Christmas trees has been rising for some years.

In a series of blogs, we look at reasons to invest in certain sectors of the Transportation Layer. First up, we look at the aerospace industry.

Continuing with our series of blogs, looking at reasons to invest in certain sectors of the Transportation Layer, we examine the shipping industry.

Lloyd’s has launched a new multi-million-pound space insurance policy for the emerging private spaceflight industry as it seeks to capitalise on the growing space market.

Pacific Gas & Electric is under pressure to increase compensation to victims of the 2017-18 wildfires or face being taken over by State and Local Government in California.

Reputation is top of the agenda for many organisations but can it be insured?

Boeing suffered another blow in the ongoing grounding of the 737 Max as it reported a $40 million third quarter loss in 2019.

All industries face disruption from technology.

Ahead of the FERMA Forum in November, Suki Basi speaks to FERMA News on the importance of European Risk Management.

Two of the world’s largest oil facilities in Saudi Arabia were targets of drone strikes.

Russell Group attended the 2019 Monte Carlo Rendezvous this year meeting with clients, markets peers and (re)insurance thought leaders who attended the event.

Re/insurers will need better data exchange across the distribution chain to enable them to analyse their exposures with confidence.

Over the last few months, there has been much discussion in the Casualty class about how recent “Market-Turning Events” (MTE) such as Enron are falling out of the collective memory.

Climate Change is changing drastically changing the nature of Hurricanes. The impact for (re)insurers could be severe.

The summer is upon us. For many, it will be a chance to catch some sun and enjoy a well-earned rest. Yet, for many, it will be an opportunity to catch up on some reading.

In the final article, in a series on geopolitics and global trade, we ask can geopolitics be quantified?

Boris Johnson enters Downing Street knowing that the success of his reign will depend on one single issue: Brexit.

In the latest in a series of articles on geopolitics and trade, Russell explores the credit insurance perspective.

As the US-China trade war deepens, what will be the impact of the imposition of new tariffs?

In the first of our series on geopolitics and global trade, we take a deeper dive in the sophisticated financial warfare between the US and China.

What will be the effect of the geopolitical disruption on global trade?

Casualty underwriters are facing a significant challenge from the emergence of new risks that cut across traditional speciality classes writes Suki Basi in Insurance Day.

Russell Group CEO Suki Basi was interviewed in the Voice of America on how recent events in the Strait of Hormuz could impact global trade.

Boeing secured a 200 737-plane order from IAG, the first major order since the 737-Max groundings.

China's political leaders are concerned about what they call the "Malacca Dilemma". With tensions rising with the U.S almost on a daily basis, they should be worried.

The closure of the Strait of Hormuz could wipe $10 billion per week from global trade according to analysis by Russell Group.

Numerous large claims have caused underwriting losses at marine insurer the UK P&I Club, in a line of business practitioners agree is particularly tough at this time.

As the energy industry continues to change, insurers have to differentiate between similar risks in the up- and downstream markets.

Russell Group CEO Suki Basi will be speaking at the IUA on Tuesday 14th May.

Join on Wednesday 26th June, for a panel discussion of leading corporates and (re)insurers chaired by Russell Group CEO Suki Basi to discuss how a "Russell Score" can quantify corporate risk.

Norsk Hydro ASA, the world’s biggest aluminium producer is expected to lose more than $40 million in the weeks following last week’s ransomware attack.

Boeing suffered another blow in the ongoing grounding of the 737 Max as it reported a $40 million third quarter loss in 2019.

An Atlas Air 767 freighter aircraft crashed outside of Houston, killing three people on board.

Mondelez has sued Zurich for $100 million for its refusal for non-payment for damages caused by 2017's NotPetya cyber attack.

Apple’s shares plummeted by 8% after a reduction in its financial forecasts.

Brexit is causing many a sleepless night for corporate risk managers and indeed their insurers.

The recent O2 data outage highlights the increasing need for organisations to know their connected exposures before they impact their business.

With Boeing under scrutiny from the Federal Aviation Administration and Indonesian authorities, we take a deeper look at the Boeing 737 Max 8.

In a roundtable hosted by Russell Group in association with Reinsurance, leaders from the reinsurance industry discussed moving towards multi-class products.

Understanding the concept of Connected Risk helps (re)insurers understand not only their known and unknown exposures but managing their peak exposures too.

Connected risk is fracturing balance sheets in the corporate world, which in turn threatens to create a feedback loop in the global (re)insurance market.

Recent Casualty loss events highlight the growing rise of multi-class events.

the combined effects of Climate Change, economic developments and political imperatives raise the possibility of a third route in Antarctica

The aviation industry is finding itself in the midst of a US-China trade war.

Russell Group CEO Suki Basi spoke at Chatham House on the topic of 'Super-Cities'.

The current new ‘hype’ within the insurance industry is both big data and automation.

The failure of a corporate to deal with climate change could have a disproportionate effect on the company itself, its supplier and partner organisations and the entire industry.

"Connected Risk" is fast becoming a buzzy new concept, but what is it, and what does it mean in practice?

The UK’s involvement in the EU’s GPS project, Galileo is facing an entirely different kind of inquisition – one that is fraught with geopolitical risks, consequences and opportunities.

The recent political conflicts involving the UK and Russia highlight how interconnected the world is.

This decade has been dominated by the rise of the social media giants such as Facebook.

In the next of our series on the top Connected Risks in 2018, we analyse the impending GDPR regulation.

In the next of our series on the top Connected Risks in 2018, we analyse the relationship between private capital and public debt.

The insurance community is now grappling with the key question of whether Climate Change is insurable.

Russell Group CEO Suki Basi writes in Airmic news on how managing supply chains is now shifting towards a focus on the impact of systemic and cataclysmic risk.

Our latest infographic explores the role of credit insurance in supporting exporters.

If 2016 was the year of political earthquakes, then 2017 will be the year of Mother Nature’s wrath.

Every organisation operating in the Connected World needs to know and understand their exposures.

Our new infographic explains what the impact of big data will have on the supply chains of tomorrow:

Risks are becoming interwoven and interconnected, on a scale not seen before. As a result, an event may no longer just affect one class of business writes Suki Basi in Insurance Day.

In this infographic, we explore how recent events such as Hurricane Harvey and future risks such as GDPR are impacting all classes of business.

Houston is the artery that keeps America’s heart pumping. Yet, the cost of Hurricane Harvey had it hit the Houston shipping canal would have been devastating.

Driverless cars raise questions about the increased risk represented by manufacturers, their suppliers and service providers.

Insurance Day reports on Russell Group's exclusive Breakfast Briefing on Connected Risk held at the Old Library at Lloyd's on Tuesday 18th July

The re/insurance sectors have been warned not to repeat the mistakes of the past as the industry continues to look at its strategy to cope with the world of big data and connected risks.

(Re)insurers and corporates may feel that they are being overloaded with too many 'unknown unknowns'.

This week, risk managers gathered at Birmingham for Airmic 2017 to mingle, network and debate all the pressing issues facing the profession from cyber risks to Brexit.

Suki Basi writes in Insurance Day about why using customer data can create both huge opportunities and risks.

Suki Basi took part in an Insurance Day Roundtable on the implications of Climate Change on Underwriting, Regulation, Risk Modelling and Asset Management.

In this infographic, we explore the new trends that are impacting customer spending:

Our world is more connected than at any time in history – and business has never been so exposed to connected risk.

Last weekend’s IT glitch at British Airways affecting 1,000 flights in Heathrow and Gatwick demonstrates how vulnerable are all industries to ‘Connected Risk’.

The latest issue of Connected Risk Weekly explores why CIOs want more help in dealing with cyber threats.

Digital gurus from insurance, government, tech and counter-terrorism assessed the current cyber security landscape at the WSJ Pro Cybersecurity Forum.

The industrial-scale global cyber-attacks with 200,000 victims across 150 nations including Britain’s National Health Service and the Russian Federation’s Interior Ministry were no freak coincidence.

Our latest infographic explores how the organisation's business models are changing due to the rise of the Internet and big data.

The line between Machine Learning and Deep Learning is quite blurred: it is a matter of complexity in the type of toolset that is being used.

The triggering of Article 50 creates a prolonged period of uncertainty for Corporate Risk Managers.

Theresa May formally announced the triggering of Article 50, signaling the UK’s departure from the European Union.

With Article 50 being triggered today, the coming two-year period will see a furious debate over whether Brexit will be a success or a failure.

Over the next years, the UK will be locked into a duel of fates with the EU as it tries to renegotiate its relationship with the bloc.

2016 was the year of unpredictability. For the laymen it was shocking but for Lloyd’s Underwriters, it was even more alarming.

What are the social and digital forces that are operating in the connected risk framework?

Artificial Intelligence is not only moving into our homes but in the workplace.

For many, Blockchain is another buzzword doing the rounds on business publications. Yet, what is Blockchain?

Some 200 years later, the Luddites are rising once again. This time, they are back with a vengeance.

Social media is a new risk driver which has fractured news distribution outlets and driven a new kind of “extreme politics”

Suki Basi wrote in Insurance Day about how Brexit and the reconfiguration of trade credit risk will expose corporate risk managers and their insurers to significantly connected risks.

Russell Group’s latest infographic exploring the rising tide of geopolitical risks and violence in a connected world.

Russell Group’s February 2017 Newsletter examines the effects of geopolitical risk and violence for corporate risk managers and (re)insurers operating in a connected risk framework.

‘When America sneezes, Mexico catches a cold’. This phrase has been deployed countless times to describe the close relationship between the USA and Mexico

Suki Basi took part in an Insurance Day Q&A discussing the opportunities for the London Energy Market and how profitable business can be found in the market.

A recent report argues that the UK Public Sector, which stands at 5.3 million, must adapt to a rapidly changing world, with technological and demographic pressures.

Suki Basi writes in Maritime Risk International on the challenges for shipping interests in finding the right insurance.

Russell Group’s latest infographic analyses the political and credit risks in a connected world.

There are many challenges and risks facing global corporates in today’s fracturing geopolitical environment.

The maritime industry has never been short of risks. The fact is that ancient mariners thrived on risk, which they saw as an opportunity to make their fortunes.

The Aerospace & Defence industry is under pressure from price, risk and expansion according to PwC’s report A&D Insights: Programmes Under Pressure.

Russell Group’s Christmas Infographic looks at the need to implement an integrated risk management strategy to deal with risk in a connected world.

Natural Perils, is a Connected Risk driver that traverses through and across all industrial sectors.

Underwriting is threatened by a combination of geopolitical risks not seen since the 1980s.

Russell Group’s latest infographic traces the growing disconnect between corporate risk managers’ expectations and (re)insurers’ ability to deliver.

Russell Group’s November 2016 Newsletter discusses how corporate exposure is on the rise and increasingly connected by geographies and class of business.

Corporates are exposed to a network of connected risk which leaves them at risk of security breaches.

The UK Government’s new Cyber strategy will help corporate risk managers and insurers to navigate through the new digital landscape.

Building a bottom-up approach to underwriting, analytics and risk modelling that considers the multi-class nature of Nat Cat exposures.

Making sense of a continued theme from the 2016 Baden-Baden Conference: The Need for the market to innovate to grow.

Russell Group’s Latest infographic discusses how Marine Underwriters can navigate the post-Hanjin landscape.

Russell Group’s October 2016 Newsletter discusses how the (re)insurance industry must embrace technology and be innovate to remain relevant.

The (re)insurance industry is grappling to understand its risks and unknown risks, reinforced by the recent Yahoo cyber hacking.

In a Reactions interview, Suki Basi argues that underwriters may not have picked up the build-up of risk correlations within and between speciality lines.

Why the recent Hanjin collapse has forced (re)insurers to rethink their connected risk exposures.

The message from Rendez-Vous Monte Carlo 2016 was for the reinsurance industry to be innovative and embrace technology to stay relevant.

Ahead of the 2016 Monte Carlo conference, Russell Group issues a press release arguing for a Connected Risk strategy to deal with the ‘perfect storm’.

A key concern of (re)insurers in the current market is their inability to quantify the effect of a systemic casualty event on their portfolio.

A survey by Russell Group of (re)insurers in European and US casualty markets reveal that reducing premiums, increasing exposures and connected risks are main concerns in 2016.

In an Insurance Day article, Suki Basi examines the current casualty risk landscape.

The new age of extreme connectivity is making underlying exposures difficult to spot.

Political Violence is an increasing risk.

The Insurance sector needs to invest financial resources in new Speciality class models.

Drones and Internet of Things (IoT) have potential to cause problems for aviation underwriters.

Will Blockchain be a disruptive force for (Re)Insurers?

Suki Basi in an Inside Fac article, outlines the specialty class (re)insurance challenges in 2016.

Russell Group’s latest infographic explores the challenges for today’s aviation industry.

The Aviation industry needs to understand the implications of increased connectivity and dependency on IT.

Underwriters need to understand the interconnected nature of risk.

2016 is not an exciting time for Underwriters and Brokers.

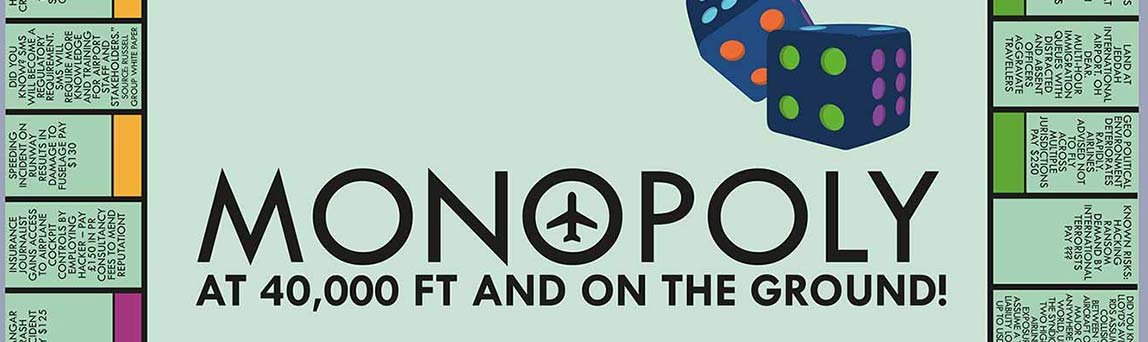

To understand different aviation risk scenarios, we need to think outside the ‘Black Box’.

Drones are undermining Airport Safety Risk Management.

What are the top 10 dangerous airports in the world?

The Tianjin Explosion demonstrated the potential of major losses to surprise even experienced underwriters.

What are the Top 10 Cyber Risks to Offshore Energy?

Better management of catastrophe exposures is needed by Marine Cargo Insurers.

Insurers and Airlines are becoming increasingly exposed to terror.

Insurers’ lack of modelling capability for cyber will wreak havoc across the speciality classes.

Does Connected Risk cut across traditional vertical industrial structures?

The Internet of Things and Connected Products promise the most radical change since the Second Industrial Revolution.

Russell Group’s latest infographic explores the challenge for underwriters facing with larger high rises.

Russell Group’s latest infographic explores the different pressures on the global aviation industry.

What are the risk exposures in the Aviation Sector?

What are the political and terrorism risks for (Re)Insurers?

What are the trends affecting Cyber underwriters?

How the Internet of Things (IoT) has created new Cyber and Business Interruption exposures.

What are the infrastructure trends in Asia and beyond?

What were the consequences of Macondo?

What are the emerging trends in Oil and Gas sector?

Russell Group’s latest infographic takes a snapshot of the credit insurance sector.

Enterprise risk solutions can help overcome the absence of a workable cyber risk model.

The Offshore Energy Industry is facing a range of threats and disruptive forces creating higher exposures for underwriters (re)insuring that business.

Endurance Re has licensed ALPS Energy on a hosted basis for 3 years.

Underlying exposure management presents a growing threat to (re)insurers.

Airline incidents in the Middle East are giving insurers a headache.

There is an opportunity for (re)insurance market in MENA to use its expertise in covering old and emerging risks.

Munich Re renewed its ALPS License by 3 years covering Aerospace and Casualty Lines of Business.

How well is Insurance responding to cyber threats?

A new generation of data analytics and modelling expertise is key to managing 21st century risk in Asia.

Russell Group has signed an agreement to license and I.H.S shipping fleet data within its ALPS Marine software.

What are energy companies exposure to cyber risks?

Russell Group will licence and distribute Clarkson offshore energy data within its ALPS Energy software.

Russell Group will licence route data from OAG for 3 years.

The Internet of Things (IoT)’s expansion increases the threat from cyber-attacks.

Validus Re has licenced ALPS Energy for 3 years.

What are the lessons from Deepwater Horizon for the Marine and Energy Market?

Russell Group asked a panel of leading figures in Energy (re)insurance market for their take on risk accumulation and lessons from Macondo.

A joined-up approach to the energy market is needed.

(Re)insurers need to build a deeper knowledge of potential exposures in our connected world.

What are the political risk threats to (Re)Insurers.

QBE Re has extended its ALPS License by a further 3 years covering Aerospace, Energy and Casualty Lines of Business.

How the smart application of technology will drive down costs for the labour-intensive insurance industry.

What are the intangibles in the risks facing (re)insurance underwriters?

In a roundtable, Suki Basi discussed the new threat of cyber risk.

R+V has extended its ALPS Licence by 3 years covering Aviation and Space Lines of Business.

Seradata has licensed its SpaceTrak world satellite and launch data for Russell’s use in its ALPS management system.

The UK Border force is under threat from cyber risk.

Understanding Analytics for the Speciality Classes.

What are the latest trends in the Satellite Industry in 2015?

Aviation

Casualty

Reinsurance

Aviation

Credit and surety

Energy

Cyber

Reinsurance

Credit and surety

Casualty

Corporate risk

Corporate risk

Corporate risk

Corporate risk

Marine

Reinsurance

Aviation

Aviation

Reinsurance

Corporate risk

Reinsurance

We’re creative and imaginative, which allows us to think differently.

Why Russell?