The aftermath of Storm Helene reveals the multi-class risks from storms

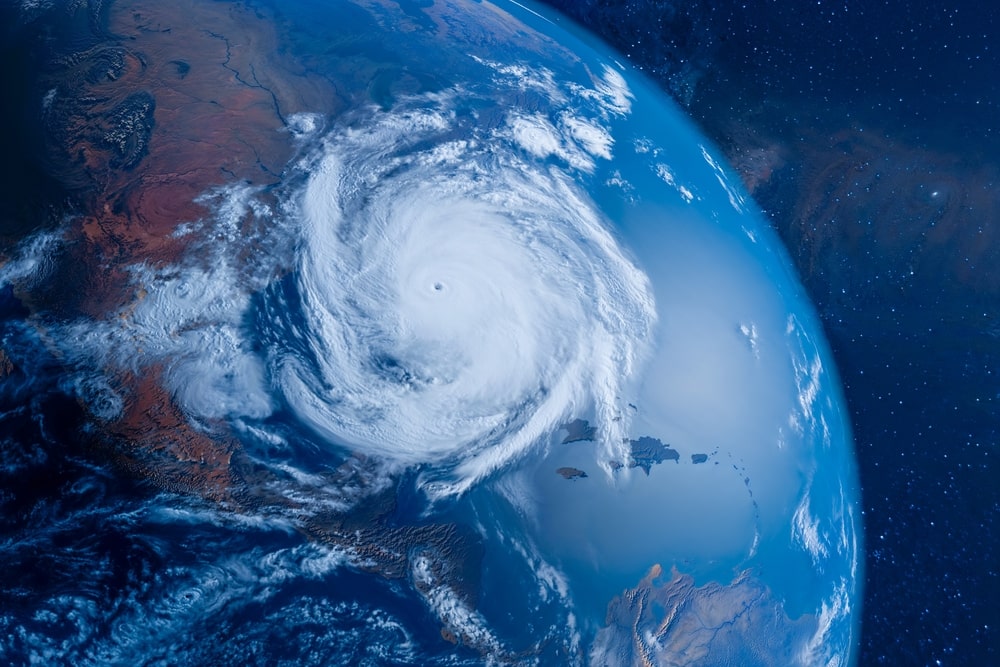

Hurricane Helene made landfall at 11.10pm EDT on Thursday 26th September about 10 miles West of Perry in the ‘Big Bend’ of Florida as a Category 4 with winds of 140mph, the strongest Hurricane to hit that region in over 150 years. Wind gusts were reported at 98mph in this location, and it was subject to significant flooding.

More than 1.28 million homes and businesses in Florida were without power today, even though Reuters reported that Storm Helene had weakened to a tropical storm. However, the still life-threatening winds and rains continued to cause major disruptions across the state and already more than a quarter (29%) of US oil production in the Gulf of Mexico has been paused due to the storm, according to the Bureau of Safety and Environmental Enforcement. An additional 17% of natural gas production has also been sidelined.

As Russell explained in a podcast earlier this year (see link to the podcast Is the storm season slow to blow due to the El Nino effect? (russell.co.uk)), a Pacific Ocean heat anomaly is creating an atypical circulation across the Atlantic. Typically, an El Niño development (a warm water anomaly across the Tropical Pacific) matches or at least becomes the driving force globally - its circulation inhibits other typical circulations.

The question we asked is could we end up with a supercharged Hurricane season (in terms of their development across the Atlantic) and an increasingly more hospitable environment for these storms to head West uninterrupted towards the US coastline and with time, into the Gulf of Mexico. Our view was that this was unlikely but could not be discounted.

Note, the conditions for Helene were by no means perfect, a large amount of shear (turbulence) was visible out to the west of the storm for most of its lifecycle, this was evident from satellite observations which showed the eye wall struggling to close on the west side of the storm. This resulted in the rapid intensification (RI) only occurring in the last 12-18 hours before landfall, whereas it could have started at least a day earlier if conditions were better across the Caribbean.

So, the storm could have been a lot stronger, and possibly even larger.

We could be seeing an unusually prolonged Hurricane season. With enough water warm (above 26.5 degrees Celsius) sustaining these temperatures into November even into December, with some areas on the Gulf Of Mexico approach record breaking temperatures, the recipe for potential for disruption/impact and ultimately cost could be starting to come together. There are also tentative signs that La Nina conditions are starting to strengthen and may reduce storminess across the Pacific, and may create less turbulence across the Atlantic and so more hospitable environment for hurricane formation.

Now that Storm Helene appears to be slowing down, there remain Business Interruption implications for manufacturers, logistics operators, airports, ship ports, energy providers and many other types of firms. Despite the storm slowdown, estimates of the economic losses generated by the storm so far range from $5-15bn in more cautious analysis to as much as $100bn according to a BBC News report, clearly as more areas are surveyed, impacted by the fast-moving and far reaching (inland) storm, the true extent of its damage will be unveiled. The human loss, which continues to mount, is of course incalculable, and our thoughts and prayers are with the families and businesses impacted by this tragic event.

Russell will be watching for developments across the Pacific and their impacts globally, but most notably upon the Atlantic storm season as it moves past its climatological peak.

Related Articles

Corporate risk

Corporate risk

Corporate risk