Over the last few months, there has been much discussion in the Casualty class about how recent “Market-Turning Events” (MTE) such as Enron are falling out of the collective memory.

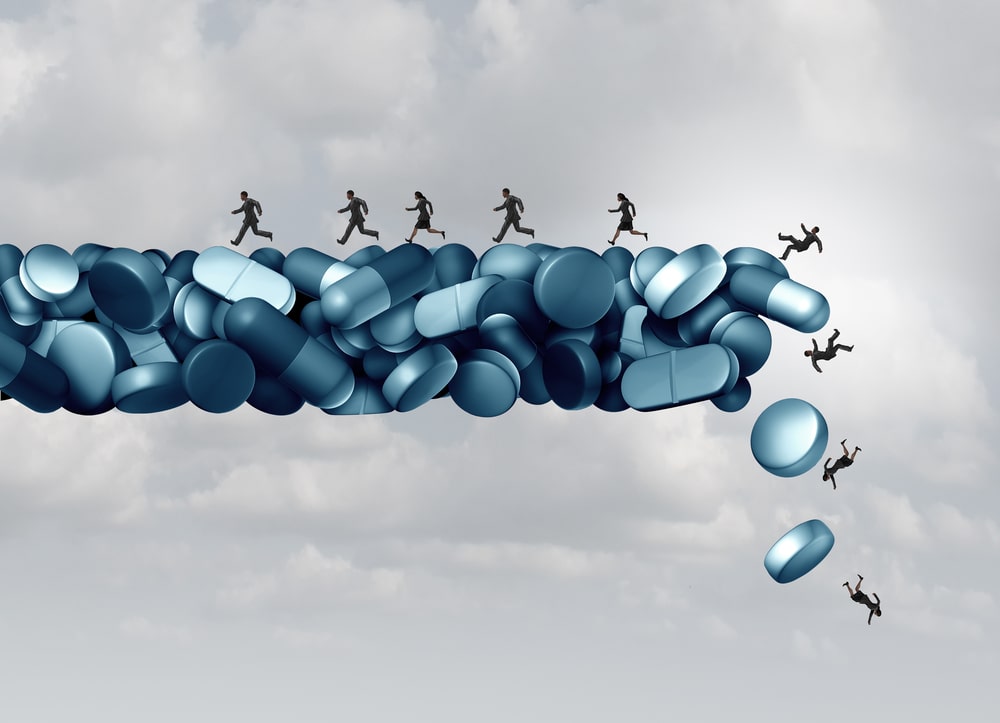

Yet, Casualty underwriters are now bracing themselves for a new potential MTE in the form of opioids. In the U.S., federal litigators are involved in over 2,300 cases across the country to seek reparations as a result of an opioids epidemic that has plagued the country.

Originally, used for people with terminal conditions such as cancer, opioid use became more widespread in the 1990s to help offset more “painful conditions” such as sporting injuries. By 2014, U.S. doctors wrote 245 million prescriptions for opioids according to U.S. news outlets.

Since 2001, the combined cost of opioid misuse, substance use disorders and premature death linked to opioid use rose from $29.1 billion to $115 billion by 2017 and will hit $199.9 billion in 2020 according to PBS (the U.S. Public Broadcasting Service).

This growing epidemic in the U.S. has resulted in the largest civil ligation case since the 1998 litigation and settlement of cigarette manufacturers following the establishment of the link between tobacco and cancer. Federal prosecutors are targeting the large U.S. drug companies, citing their “controversial marketing techniques” and dismissal of the scientific evidence of the addictive power of opioids.

In September, Johnson & Johnson was ordered to pay $572.1 million to the State of Oklahoma for its role in the epidemic. A ruling that followed the $270 million that the OxyContin maker, Purdue Pharma (owned by the Sackler Family) was ordered to pay in March. This forced Purdue to file for Chapter 11 bankruptcy. Mallinckrodt reached a $30 million deal with two Ohio counties and Teva was ordered to pay $85 million to Oklahoma too.

Yet, as the federal investigation widens its scope, questions have been asked of the Federal Government too. The Drug Enforcement Agency (DEA) increased the production quotas for oxycodone - despite scientific evidence showing the negative impact of it - by 400% from 2002 to 2013 according to the investigations by the Justice Department.

So, while the civil litigation cases continue in the U.S. – with the added support from the Federal Government with the Department of Health and Human Services (HHS) offering $1.8 billion in funding – the spotlight pivots to the insurance and in turn, the Casualty class. In its court filing for bankruptcy, Purdue’s insurance premiums were revealed to be a total of $3.2 million.

The question is, what next? Pharmaceuticals are being targeted now but might they be the tip of the litigation iceberg? It is estimated that there are approximately 67,000 pharmacies in the U.S. Almost half (33,000) is located within drug stores, grocery stores, hospitals, department stores, medical clinics, surgery clinics, universities, nursing homes, prisons, and other facilities. Meanwhile, according to Statista there are around 1.1 million doctors in the U.S. The pharmaceutical companies developed the drugs but someone had to prescribe their use and then distribute them. That is a lot of potential actors in the connected liability chain.

The opioid civil litigation helps to define what Russell calls “the new era of liability”, an epoch of greater complexity within the Casualty class, in which risk cuts across all classes of business.

Senior underwriters and management need to ensure that robust risk mitigation policies are put in place so that (re)insurers are not caught out by “Market-Turning Events.”